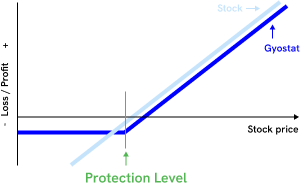

Gyrostat class A and class B are designed for investors who want financial peace of mind irrespective of stock market outcomes. This is a key objective for many in retirement planning.

Gyrostat Risk Managed Equity Fund Classes A & B have downside protection always in place, regular income, with returns in rising and falling markets including large market falls.

Our class A flagship fund has 3 key features:

-

Lower risk than ASX 200 (source: FE Analytics)

14-year track record no quarterly losses > 3%, 4 Yr max qtr loss -1.53%

-

A track record of increasing in value on major market falls

-

Absolute returns with a track record of increasing with market volatility

The leveraged Class B Units have a focus on greater returns and less risk protection.

These returns are non correlated with the market providing portfolio diversification benefits such as lower risk, higher risk-adjusted returns, and reduced exposure to market shocks.

Class A: Absolute return income equity

Target returns: 6-8% pa in trending markets> 8% in changing markets

Target Income: BBSW3M +3.61% pa paidquarterly (Currently 6.74% pa)

Class Inception: 10 December 2010

| As at 31 Jan 2026 | 3M | 1 Yr p.a. | 2 Yr p.a. | 3 Yr p.a. |

|---|

| Class A |

1.50% |

9.70% |

9.65% |

8.44% |

| BBSW 3M + 3% |

1.66% |

7.05% |

7.33% |

7.27% |

| Excess Returns |

-0.16% |

2.65% |

2.32% |

1.17% |

Class B: Leveraged absolute return income equity

Target returns: Minimum BBSW3M + 6%

Target Income: BBSW3M +3.61% pa paidquarterly (Currently 9.74% pa)

Class Inception: 13 April 2021

| As at 31 Jan 2026 | 3M | 1 Yr p.a. | 2 Yr p.a. | 3 Yr p.a. |

|---|

| Class B |

1.78% |

12.14% |

10.46% |

10.31% |

| BBSW 3M + 3% |

1.66% |

7.05% |

7.33% |

7.26% |

| Excess Returns |

0.12% |

5.09% |

3.13% |

3.05% |

View our monthly reports